Be Safe While Driving This Summer – Common Summer Driving Hazards

Summer is a time for vacations, road trips, and enjoying the sunshine. However, it’s also a season with unique driving hazards that can catch even the most experienced drivers off guard. Knowing what to look out for can help you stay safe on the road. In this blog, we’ll discuss the most common summer driving hazards and how to handle them.

1. Construction Zones

1. Construction Zones

Summer is peak season for road construction. You’ll often encounter orange cones and detour signs on highways and local roads. Construction zones can be confusing and lead to sudden lane changes and reduced speed limits.

How to Handle It:

- Stay Alert: Watch for signs indicating construction zones ahead.

- Slow Down: Obey reduced speed limits and be prepared for sudden stops. Do not be aggressive in the construction zones.

- Follow Directions: Pay attention to flaggers and signs directing traffic.

- Be Patient: Exercise patience. A construction zone is an inconvenience, but you will make it through. One thing we all do is complain about the quality of our road infrastructure, but still get frustrated with construction zones.

2. Increased Traffic

Summer brings more drivers to the road, including vacationers unfamiliar with local routes. Traffic congestion can lead to frustration and increased accident risks.

How to Handle It:

- Plan Ahead: Check traffic reports and plan your route accordingly. Use your GPS, even if you know where you are going, so it can give you traffic updates and steer you around it if necessary.

- Be Patient: Allow extra time for your journey to avoid rushing.

- Stay Calm: Keep a safe distance from other vehicles and avoid aggressive driving. Nothing positive can come out of road rage. Plus, these days, you never know how the other party will react.

3. Tire Blowouts

Belive it or not, you own tires can be one of the biggest Summer driving hazards. Hot pavement can cause the air inside your tires to expand, leading to blowouts. This is especially dangerous at high speeds on highways.

How to Handle It:

- Check Tire Pressure: Ensure your tires are properly inflated before hitting the road.

- Inspect Tires: Look for signs of wear and tear, such as cracks or bald spots.

- Carry a Spare: Make sure you have a usable spare tire and know how to change it.

- Get Out Of Harms Way: If you have a blowout, try to get your car off the road and out of the traffic ways. You may even want to wait outside of your car behind a guardrail if possible.

- Know Who To Call: Having the appropriate numbers to your roadside assistance company and your insurance company readily available. It is even a great idea to store them in your cell phone.

4. Overheating Engines

High temperatures can strain your vehicle’s engine, leading to overheating, which can leave you stranded.

How to Handle It:

- Check Coolant Levels: Regularly check and top off your engine coolant.

- Monitor Temperature Gauge: Keep an eye on your vehicle’s temperature gauge, especially during long drives.

- Take Breaks: Give your car a rest during long trips to avoid overheating.

5. Glare and Sunstroke

Bright sunlight can cause glare, making it hard to see the road. Additionally, prolonged exposure to the sun can lead to driver fatigue and even heatstroke.

How to Handle It:

- Use Sunglasses: Wear polarized sunglasses to reduce glare.

- Sun Visors: Use your vehicle’s sun visors to block direct sunlight.

- Stay Hydrated: Drink plenty of water and take breaks in the shade to avoid heat exhaustion.

6. Sudden Storms

Summer thunderstorms can appear out of nowhere, bringing heavy rain, strong winds, and reduced visibility. This creates a huge Summer driving hazard.

How to Handle It:

- Slow Down: Reduce your speed in heavy rain to prevent hydroplaning.

- Use Headlights: Turn on your headlights to improve visibility. Most, if not all, state laws require you have your headlights on in the rain. But it still amazes me how many people still do not turn on their headlights during rainstorms. Do not rely on the auto headlight feature as it does not always turn them on if it is not dark enough out.

- Pull Over: If the weather becomes too severe, find a safe place to pull over until it passes.

7. Wildlife on Roads

More animals are active in the summer, increasing the chances of encountering wildlife on the road. This makes them a Summer driving hazard.

How to Handle It:

- Stay Vigilant: Watch for wildlife crossing signs and be alert, especially at dawn and dusk.

- Use High Beams: In rural areas, use high beams when appropriate to spot animals from a distance.

- Brake, Don’t Swerve: If an animal appears suddenly, brake firmly and avoid swerving to prevent losing control. If it comes down to hitting the animal or taking aggressive action to avoid it, hit the animal. Swerving can cause you to hit an object or even another vehicle. Check out Nancy’s blog titled – Deer Can’t Sue You!

Summer Driving Hazards Conclusion

By being aware of these summer driving hazards and knowing how to handle them, you can ensure a safer journey for you and your passengers. Always prioritize safety over speed, and enjoy the summer travels responsibly.

In today’s digital age, attorneys are increasingly becoming targets for cyber criminals. With sensitive client information at stake, the legal industry needs robust cyber security measures. This post will guide you through essential cyber security strategies tailored specifically for attorneys.

In today’s digital age, attorneys are increasingly becoming targets for cyber criminals. With sensitive client information at stake, the legal industry needs robust cyber security measures. This post will guide you through essential cyber security strategies tailored specifically for attorneys.

Backup systems in your home, such as home generators, standalone generators, and battery backups for sump pumps and other household systems, are essential for maintaining safety and comfort during power outages. However, it’s crucial to regularly test these home backup systems systems to ensure they will work when you need them the most. Here’s why and how you should keep your backup systems in top shape.

Backup systems in your home, such as home generators, standalone generators, and battery backups for sump pumps and other household systems, are essential for maintaining safety and comfort during power outages. However, it’s crucial to regularly test these home backup systems systems to ensure they will work when you need them the most. Here’s why and how you should keep your backup systems in top shape.

When it comes to

When it comes to

In the insurance world, terms like “soft market” and “

In the insurance world, terms like “soft market” and “

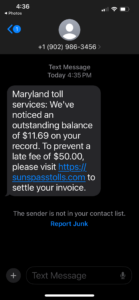

If you’ve recently received a suspicious text message claiming to be from Maryland Toll Services, you’re not alone. Scammers are increasingly using text messages to target unsuspecting victims with fraudulent claims about unpaid tolls. Here’s what you need to know to protect yourself from falling victim to this scam. The MD

If you’ve recently received a suspicious text message claiming to be from Maryland Toll Services, you’re not alone. Scammers are increasingly using text messages to target unsuspecting victims with fraudulent claims about unpaid tolls. Here’s what you need to know to protect yourself from falling victim to this scam. The MD The Message: You receive a text message from what appears to be Maryland Toll Services or MDTA. The message claims that you have unpaid tolls and provides a link to a website where you can supposedly pay the outstanding amount. ( See the actual scam text that I recently received, which triggered me to write this blog)

The Message: You receive a text message from what appears to be Maryland Toll Services or MDTA. The message claims that you have unpaid tolls and provides a link to a website where you can supposedly pay the outstanding amount. ( See the actual scam text that I recently received, which triggered me to write this blog)

When you hear about a “hard market” in the insurance industry, think of it as a tough time for both buying and selling insurance. This period comes with some challenges that make it harder for people to get insurance and for companies to offer it.

When you hear about a “hard market” in the insurance industry, think of it as a tough time for both buying and selling insurance. This period comes with some challenges that make it harder for people to get insurance and for companies to offer it.

As graduation season approaches, the air fills with the excitement of accomplishment and new beginnings. It’s a time when parents might consider throwing a party to honor their graduate’s milestone. However, incorporating alcohol in these celebrations can significantly escalate the risks, legally and ethically, especially when minors are involved. Understanding these risks is crucial for parents to ensure that a moment of celebration doesn’t turn into a legal nightmare.

As graduation season approaches, the air fills with the excitement of accomplishment and new beginnings. It’s a time when parents might consider throwing a party to honor their graduate’s milestone. However, incorporating alcohol in these celebrations can significantly escalate the risks, legally and ethically, especially when minors are involved. Understanding these risks is crucial for parents to ensure that a moment of celebration doesn’t turn into a legal nightmare.